Report to Althingi on the HF-Fund’s position and the next steps

The Ministry of Finance and Economic Affairs has issued a report on the status of the HF-Fund. The report sets out scenarios for possible evolution of the fund over the coming decades, given assumed continued operating losses, and explains the impact thereof on the Treasury given its guarantee of collection for the Fund’s liabilities. A guarantee of collection means that when a confirmation is established that the debtor is unable to make payments and does not have assets to secure the obligation, the guarantee will be effective. With a guarantee of collection the Treasury guarantees repayment of the debts’ nominal value, plus accrued interest, and inflation indexation until the settlement date.

The Minister of Finance and Economic Affairs is expected to present the contents of the report to Althingi on 25th of October.

The HF-Fund was created through the split of the Housing Financing Fund (HFF) by Act No. 151/2019, which came into effect on 31 December 2019. The workout of the HF-Fund’s assets and liabilities is aimed at minimising the risk and cost to the Treasury stemming from the HFF’s cumulative financial difficulties. These financial difficulties result from the HFF’s activities and funding arrangements coupled with large-scale prepayments on its loan portfolio. A special panel was appointed this spring to advise on the process.

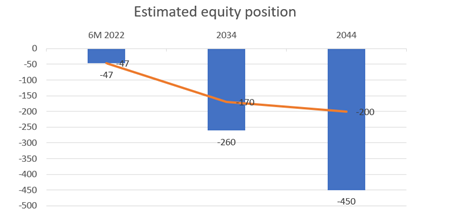

The report’s findings, which are based on the Fund’s position as presented in its 2022 interim results, show that the Fund is able to pay the principal and interest on its obligations until 2034, and that no later than that year the Treasury’s guarantee will be tested. The Fund’s equity position at that point is projected to be negative by approximately ISK 260 bn, or a present value of ISK 170 bn. Continuing to operate the Fund throughout its debt maturity horizon would require the Treasury to inject approximately ISK 450 bn, or ISK 200 bn at present value, into the Fund. If, on the other hand, the Fund would be liquidated at the current juncture and its assets sold and used to repay debts, the negative balance would amount to ISK 47 bn. On the graph below the blue column stands for nominal value and the orange is present value.

A decision needs to be taken on how to deal with this situation, including whether to allocate additional funds to the HF-Fund. As demonstrated in the report, there are arguments supporting the case for starting to seek ways to liquidate the HF-Fund so that its assets can be disposed of and its debts settled. With each passing month, the cost of the settlement for the Treasury can be expected to increase by ISK 1.5 bn, or ISK 18 bn per year. Therefore, it is important and responsible towards future generations and creditors to complete the settlement sooner rather than later, which would serve to minimise uncertainty and put an end to the continuing lossmaking and growth in the amount to be covered by the guarantee.

It is also important for the HF-Fund’s creditors to have timely and clear information on how the Treasury intends to deal with these issues. The Ministry deems it important to engage in a dialogue with the creditors and examine the basis for agreements on the settlement and liquidation of the Fund, which must be considered the optimal result and could bring a favourable outcome for all stakeholders. Steinþór Pálsson has been engaged to act as an intermediary in this dialogue, having extensive experience in the financial services sector, including as CEO of Landsbankinn.