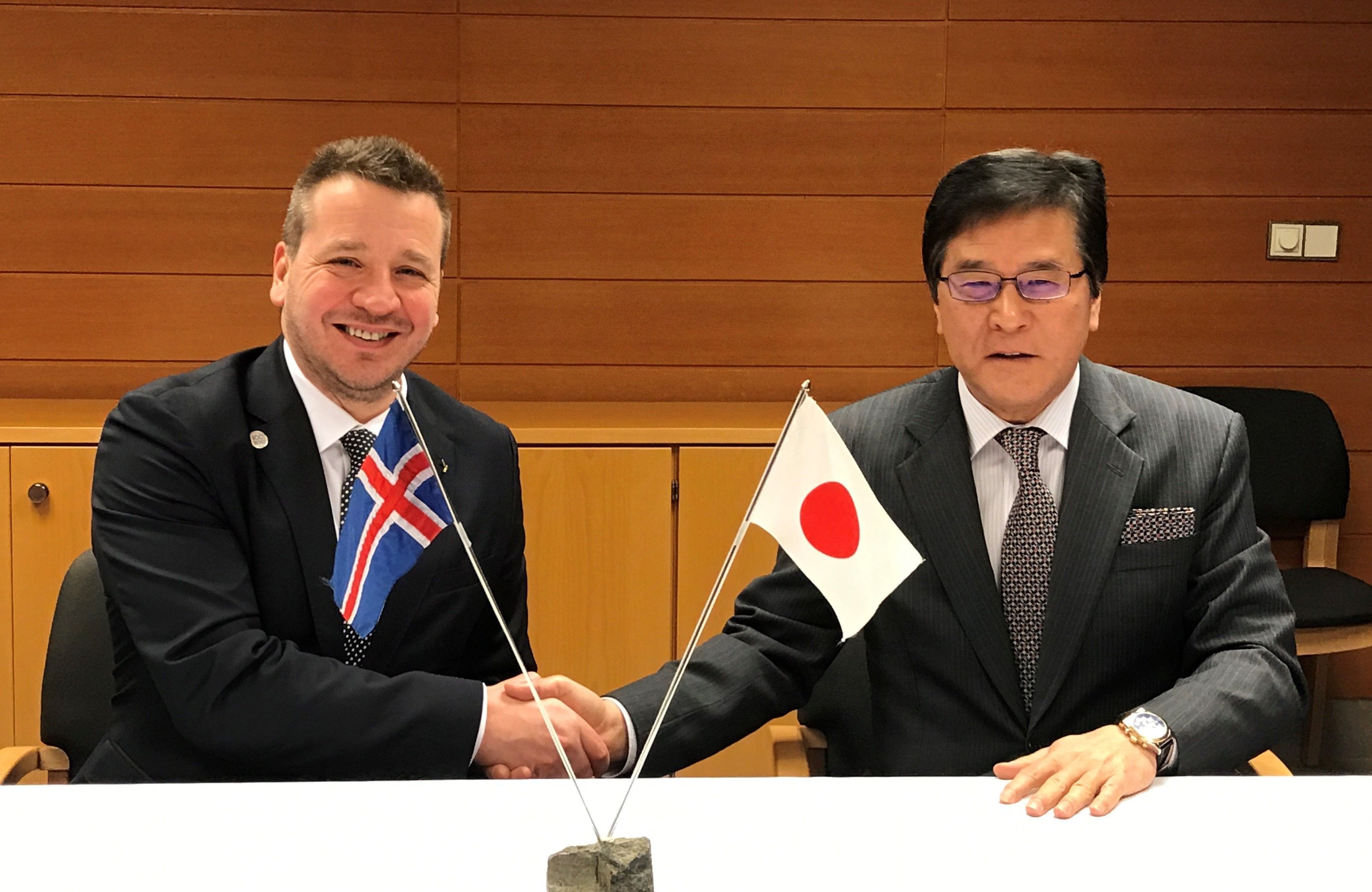

Signing of a Tax Convention between Iceland and Japan

A Convention between Iceland and Japan for the Elimination of Double Taxation with respect to Taxes on Income and the Prevention of Tax Evasion and Avoidance (hereinafter, the Convention) was signed in Reykjavik on January 15, 2018, by H.E. Mr. Guðlaugur Þór Þórðarson, Minister for Foreign Affairs of Iceland and H. E. Mr. Yasuhiko Kitagawa, Ambassador of Japan to the Republic of Iceland.

The key points of the Convention are that the taxation on dividends is exempted if the company receiving the income has held at least 25% of shares for at least the last six months and the beneficial owner of the dividends is a resident of the other Contracting State. The exemption also applies if the recipient of the income is a pension fund. The tax shall not exceed 5% if the beneficial owner of the dividends is a resident of the other Contracting State and has held at least 10% of shares for six months ending on the date on which entitlement to the dividends is determined. In all other cases 15% taxation of the gross amount of the dividends applies.

There is no taxation on interest and royalties. According to the Convention the credit method is applied in order to prevent double taxation and there is a provision on mutual assistance in the collection of tax claims. Furthermore, there is a special provision for the prevention of abuse of the Convention. It is expected that this Convention will contribute to promoting further mutual investment and economic exchanges between the two countries.

In the forthcoming months the respective authorities will proceed with the ratification of the Convention. The aim is to finalize domestic procedures and for the Convention to enter into force later this year and have effect from 1. January 2019.